WHY ALTERNATIVES?

JOIN HOW THE WORLD INVESTS

IT’S TIME FOR

INVESTING TO EVOLVE

Innovation has always made the world better, shaping how we live, work, and connect. Yet investing has been slow to evolve, with most portfolios still concentrated in traditional mutual funds. Alternatives bring innovation directly to investing, modernizing the way portfolios are built. By combining high-value alternative strategies with low-cost ETFs, portfolios can become more diversified and resilient, helping investors move forward with greater certainty.

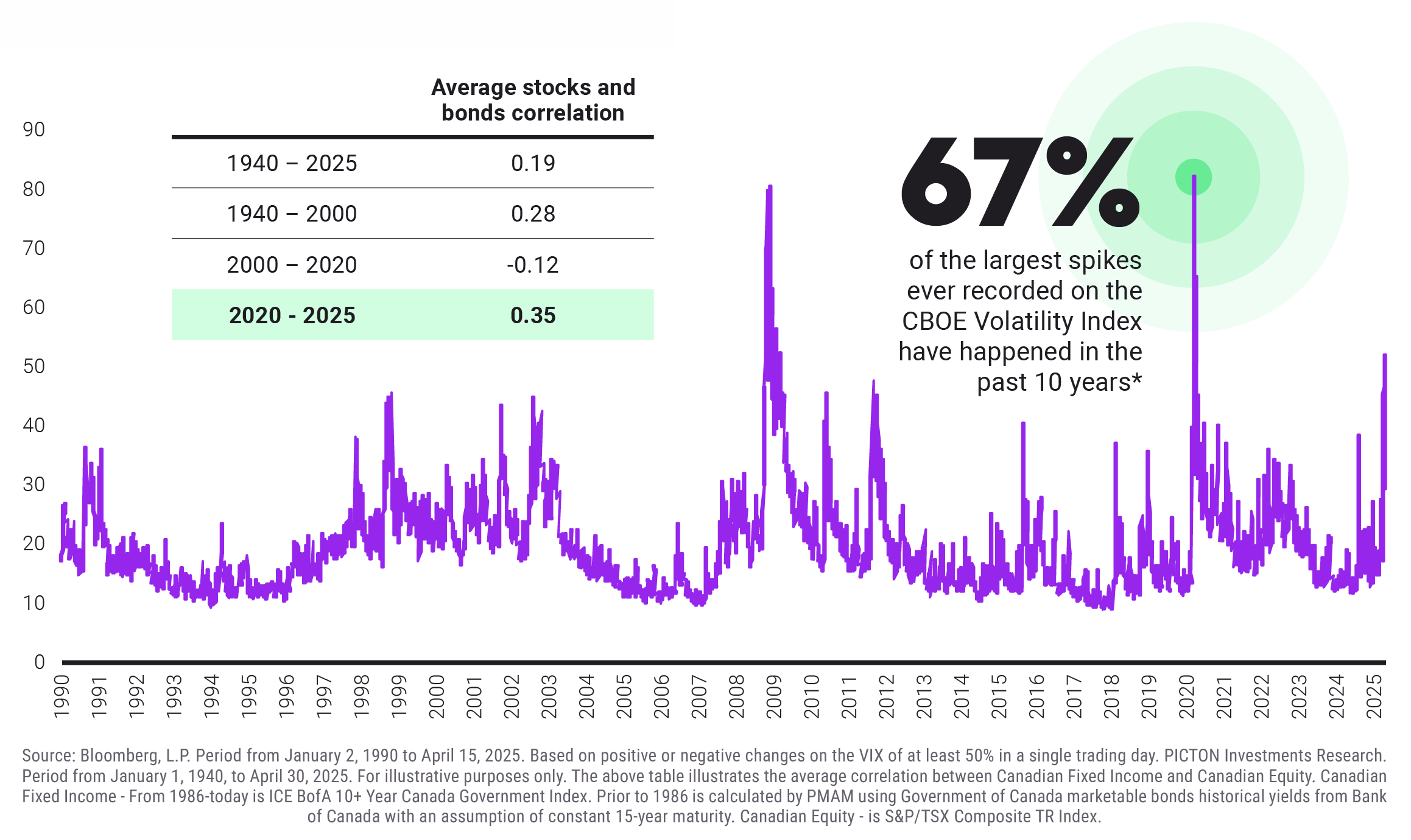

MARKETS ARE BECOMING INCREASINGLY VOLATILE WHILE STOCKS AND BONDS ARE BECOMING MORE CORRELATED

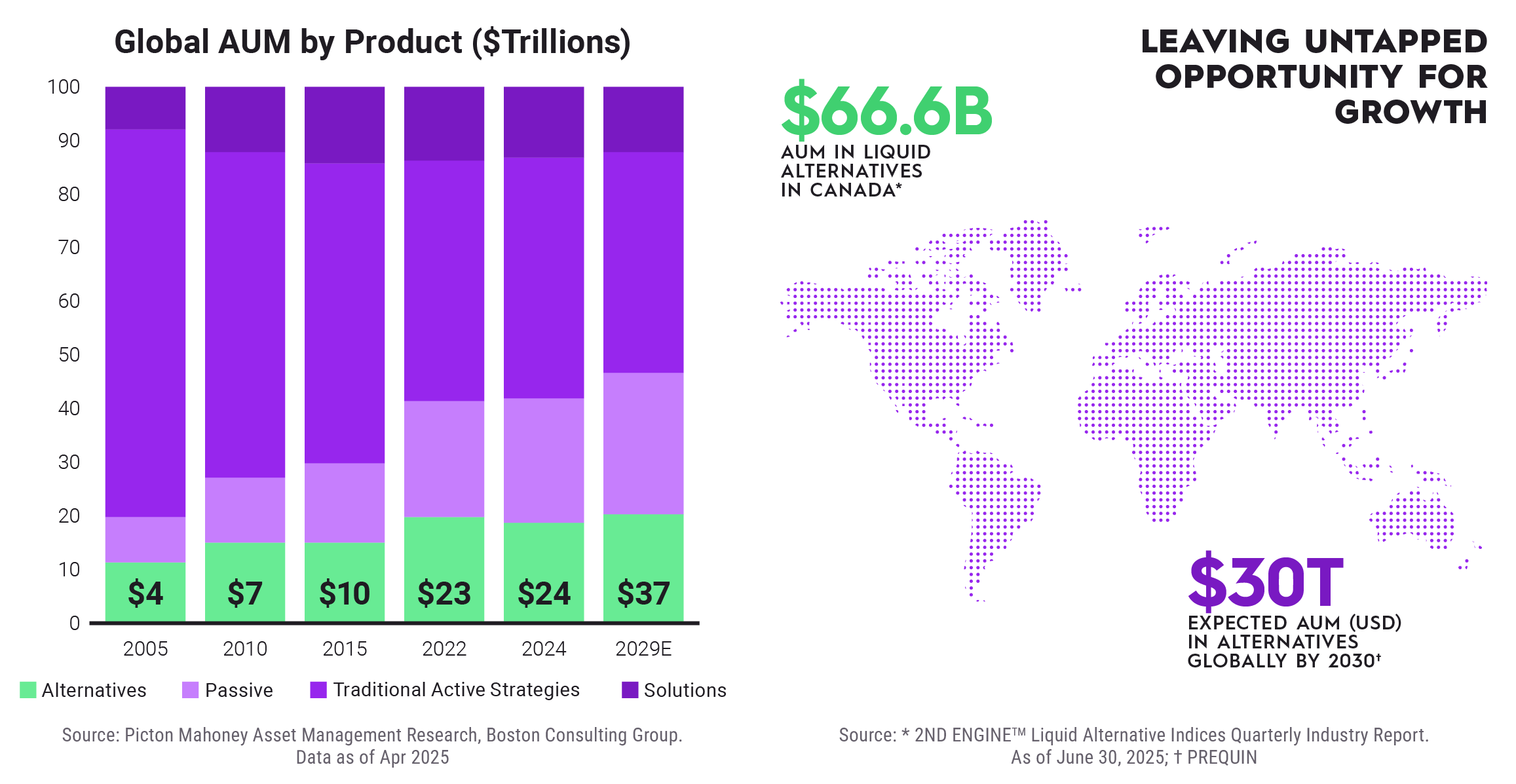

GLOBAL ALLOCATIONS TO ALTERNATIVES CONTINUE TO GROW

The global alternatives market is expected to reach $30 trillion (USD) by 2030, yet Canadian portfolios are lagging behind global portfolios. By aligning with global trends, Canadian investors can unlock the diversification, risk management, and resilience alternatives can offer.

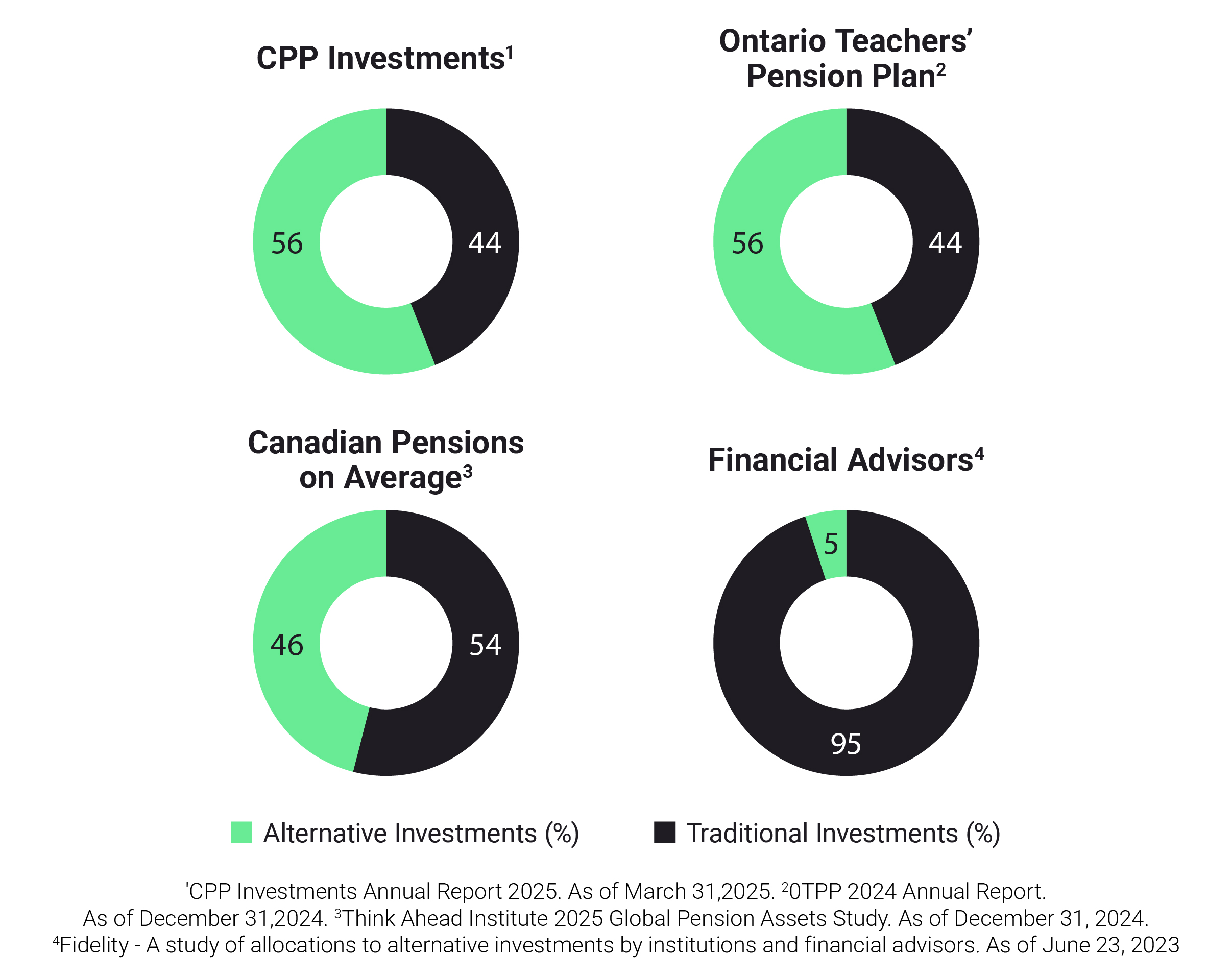

LIQUID ALTERNATIVES CAN OFFER INVESTORS OPPORTUNITY TO INVEST LIKE INSTITUTIONS

Historically offered to institutions and pension funds, the introduction of liquid alternatives now provides Canadian investors with access to strategies used by institutional investors. Compared to institutional investors, investors are still heavily concentrated in traditional assets (stocks & bonds), with just approximately 5% allocated to alternatives.

ALTERNATIVES CAN OFFER KEY BENEFITS

TO YOUR INVESTMENT PORTFOLIO

THE BOTTOM LINE:

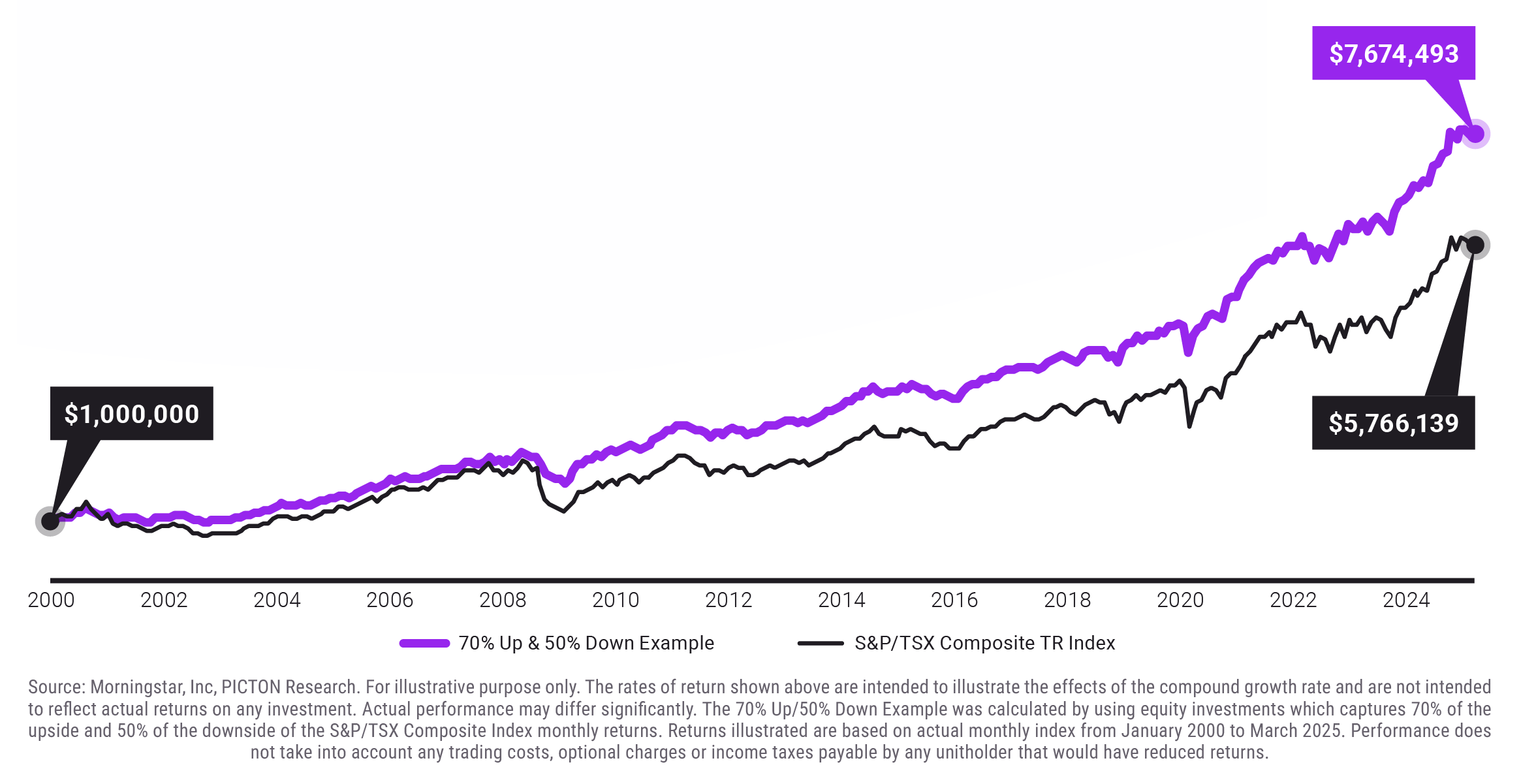

ALTERNATIVES CAN CAPTURE GROWTH IN UP MARKETS AND AIM TO PROTECT IN DOWN MARKETS

Capturing 70% Upside & 50% Downside of the Market is approximately 140% Upside & 50% Downside Over Time

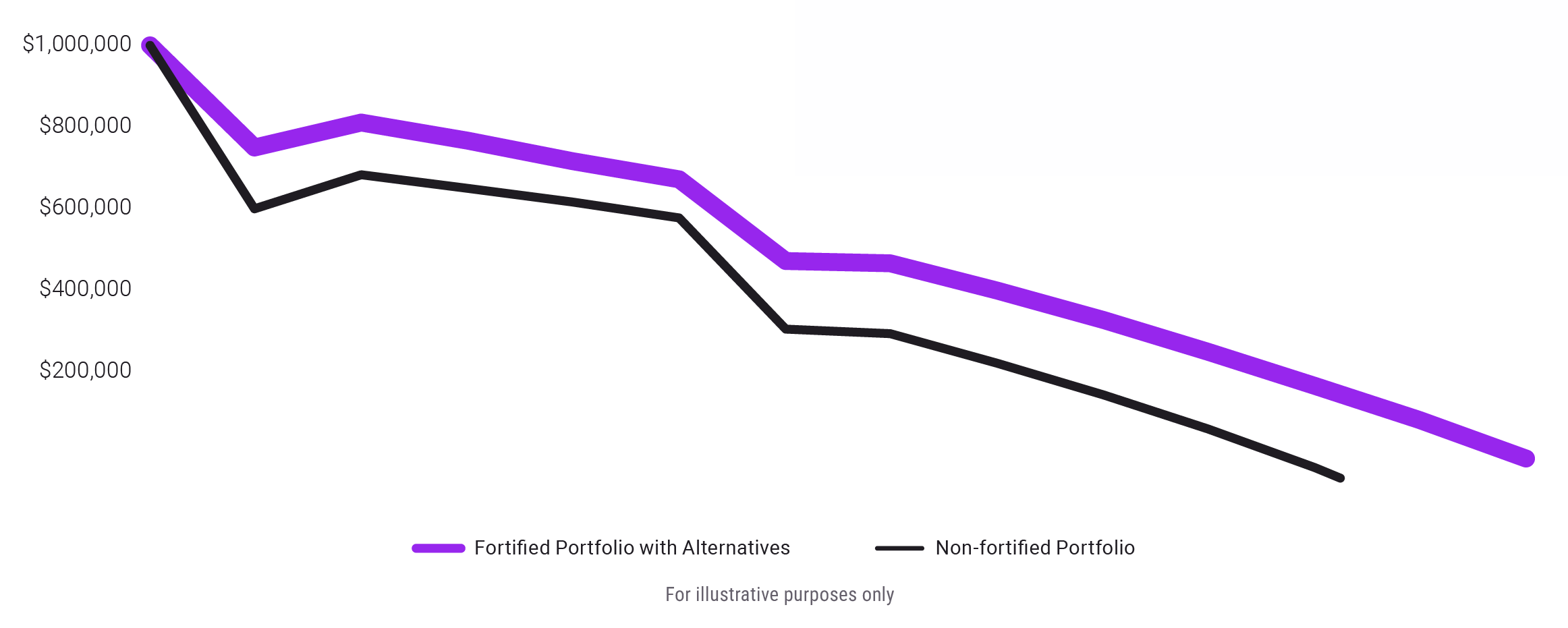

WHILE AIMING TO REDUCE SHORT-FALL DECUMULATION RISK

Sequence of returns can impact early losses making it harder to recover, no matter your life stage. Portfolios fortified with alternatives can have less shortfall risk and experience smaller drops during volatile markets.

The world is evolving and with new forms of investments, like alternatives, you now have an opportunity to evolve the way you invest. Alternatives can be essential to building portfolios that are better equipped for today’s risks and tomorrow’s opportunities. By integrating alternatives, Canadian investors can join a more advanced global approach, one that strengthens diversification, helps manage volatility, and aims to support more consistent outcomes.

Disclosure

This material has been published by PICTON Investments on August 20, 2025. It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.

This material contains “forward-looking information” that is not purely historical in nature. These forward-looking statements are based upon the reasonable beliefs, expectations, estimates and projections of PICTON Investments as of the date they are made. PICTON Investments assumes no duty, and does not undertake, to update any forward-looking statement. Forward-looking statements are not guarantees of future performance, are subject to numerous assumptions, and involve inherent risks and uncertainties about general economic factors which change over time. There is no guarantee that any forward-looking statements will come to pass. We caution you not to place undue reliance on these statements as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement made.

All projections provided are estimates and are in Canadian dollar terms, unless otherwise specified, and are based on data as of the dates indicated.