Managing alternatives with alternative data

Navigating the U.S. government shutdown

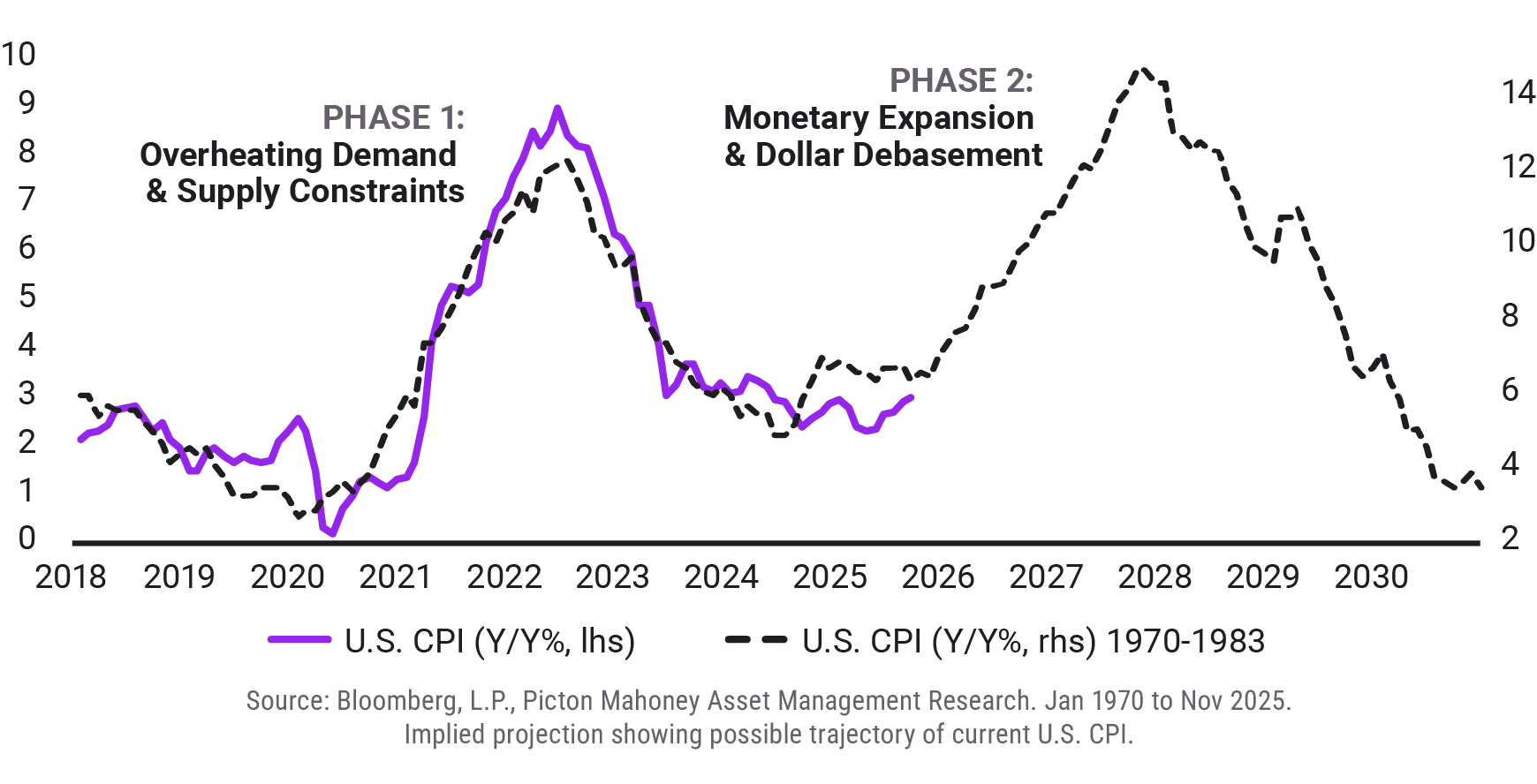

Can the Source of Inflation Tell Us What Comes Next?

Cost-Push Inflation vs. Currency Debasement

Understanding the source of rising prices is critical for navigating the current economic cycle. While cost-push inflation and currency debasement are both loosely labeled "inflation," they represent two fundamentally different forces. The former is a supply-side catastrophe, the latter is a policy-driven currency devaluation.

Cost-push inflation from a supply shock usually results from an external event such as a war, pandemic, oil embargo or drought that breaks a key supply chain. Price pressures start off narrow, then spread more broadly. Inflation starts in specific sectors (e.g., energy, food, shipping) and then "bleeds" into other sectors as costs are passed on. It's a ripple effect, not a uniform flood. The typical response from central banks is fighting inflation by contracting its balance sheet, known as Quantitative Tightening (QT), and raising interest rates to slow down the economy. If the central bank raises interest rates aggressively to fight inflation, it can make the currency more attractive to foreign investors, causing its value to rise, even as domestic prices are high. A supply shock is ultimately negative for economic growth as it is a recessionary force. While gold may rise in this scenario due to stagflation fears, the stock market and real estate often fall as high interest rates hurt corporate profits and mortgages.

The primary cause of monetary inflation, from currency debasement, is a government that is spending money it doesn't have, and a central bank that is creating new money, in other words monetizing debt, to pay for it. The central bank accommodates this spending by expanding its balance sheet through Quantitative Easing (QE) which aims to buy government bonds and keep interest rates low. In this scenario, the price of everything (stocks, bonds in nominal terms, real estate, goods and services, etc.) goes up together because the unit of measurement, such as the U.S. dollar, is losing value. In turn, the currency's value falls against other foreign currencies and commodities because its supply is being massively increased. Hard asset prices, particularly gold and real estate, rise significantly and often faster than CPI. This phenomenon is a "flight to safety" as investors flee the debasing currency in favour of tangible assets that can't be printed.

To identify the driver of rising prices, one must look past the Consumer Price Index (CPI) and observe the interaction between fiscal policy, central bank action, and asset performance. Here’s a simple breakdown of the signals to watch for:

Indicator | Monetary Inflation (Caused by Debasement) | Cost-Push Inflation (Caused by Supply Shock) |

|---|---|---|

What is the Central Bank Doing? | This is the cause. The central bank is actively "printing money" (Quantitative Easing, rapid balance sheet expansion) to fund government deficits. | This is the responder. The central bank is fighting the inflation by raising interest rates (Quantitative Tightening) to slow the economy down. |

Which Prices Rise? | All prices tend to rise together, including goods, services, wages, and assets. This is "broad-based" because the value of the money itself is falling. | Specific prices rise first and most. For example, a drought makes food prices spike and an oil embargo makes gas prices rise. Other prices then rise later as a ripple effect (e.g., shipping costs). |

How Do Hard Assets Behave? | Asset prices rise fast (often faster than goods). People flee the currency for alternatives that can't be debased. This is a "flight to quality." * Gold and Silver spike. | Asset prices often fall. A supply shock, like an oil crisis, is negative for the economy, since it raises costs, kills profits, and can cause a recession. * Gold may rise (as a fear hedge). |

How Does the Currency Behave? | The currency's value falls against other foreign currencies, if they aren't also debasing. In other words, it takes more of your dollars to buy a Swiss Franc or a Euro. | The currency's value may be stable or even rise if the central bank is raising interest rates faster than other countries’ banks to fight inflation, therefore attracting foreign capital. |

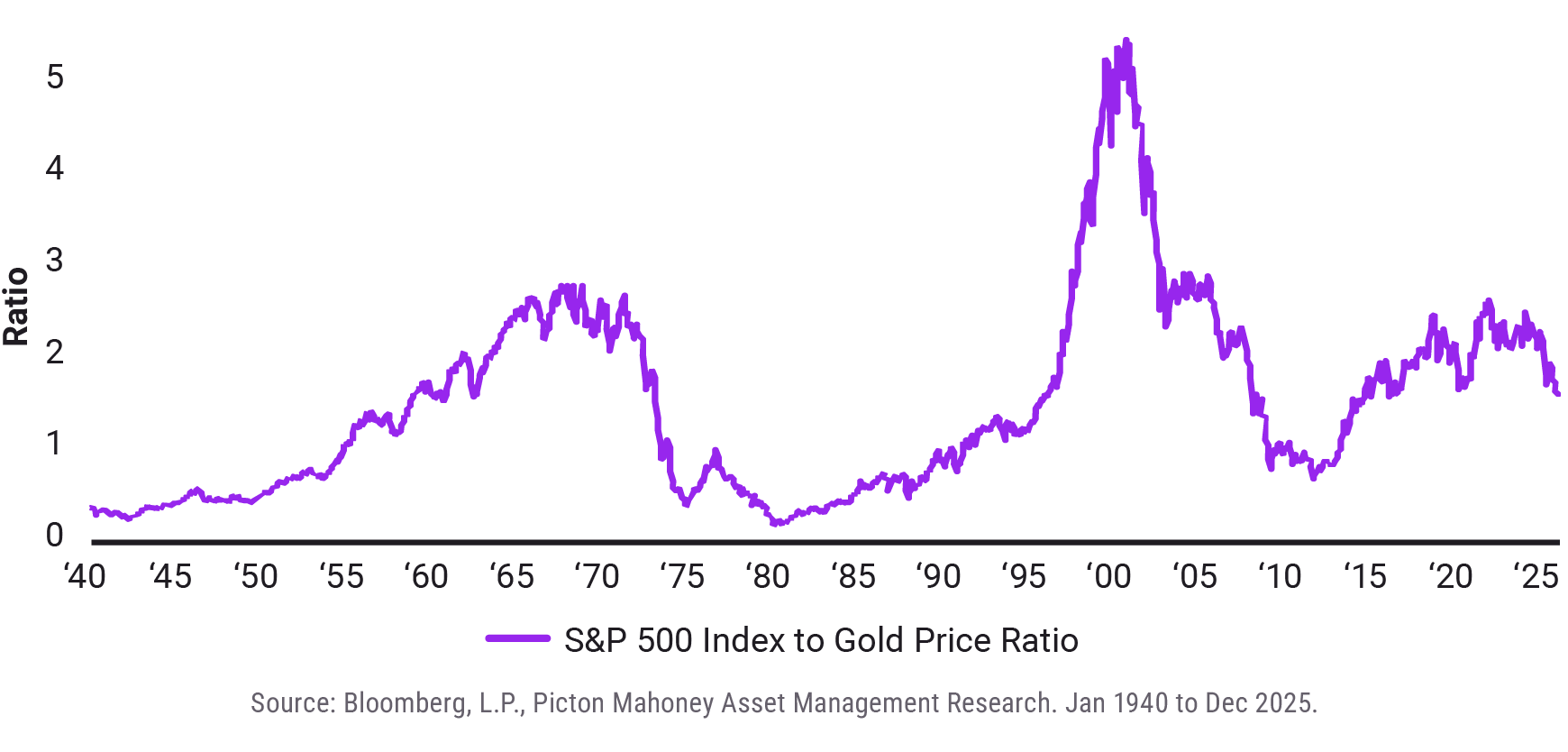

Below is a key chart that may help reframe the true drivers of inflation in 2025. While the S&P 500 Index reached a new high in nominal US dollar terms, it actually fell to multi-year lows when expressed in terms of gold:

Fiscal dominance occurs when the level of government debt is so high that the central bank can no longer independently set interest rates to fight inflation. If the central bank raises rates to combat rising prices, the interest expense on the national debt becomes so high that it threatens the solvency of the government or causes a deep systemic crisis.

In this scenario, the central bank’s primary mission shifts from "price stability" to "debt sustainability."

1970s vs. Today: The Volcker Problem

The 1970s are often cited as the blueprint for fighting inflation, but the math has changed fundamentally:

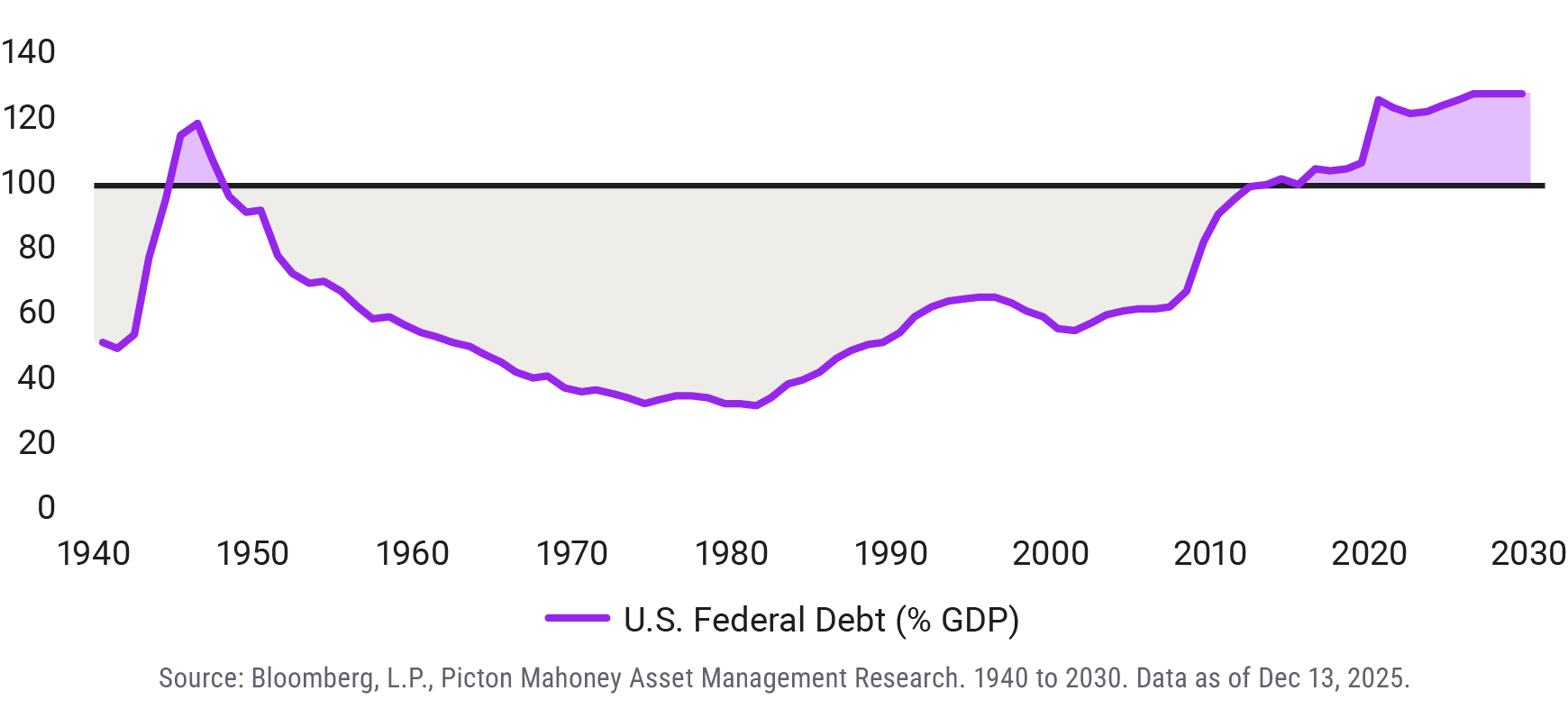

The 1970s Monetary Independence: When Paul Volcker raised rates to 20% in 1980, the U.S. Debt-to-GDP ratio was roughly 30%. The government could afford the interest payments on its debt even at massive rates. The Federal Reserve (“Fed”) was free to "crush" inflation because it didn't risk bankrupting the Treasury.

The 2020s Fiscal Dominance: Today, U.S. Debt-to-GDP is over 120%. Every 1% increase in interest rates adds hundreds of billions to the annual deficit. If the Fed were to keep rates at "Volcker levels," the interest expense alone would exceed the entire tax revenue of the government.

The 2022-2024 Cycle: Initially, the post-pandemic inflation looked like a "Cost-Push" shock due to broken supply chains, to which the Fed responded by raising interest rates. However, as the deficit continued to expand even with high rates, the Fed was forced to signal "pivots" despite inflation remaining above target. This is the hallmark of Fiscal Dominance: the Fed is forced to tolerate higher inflation because the alternative is a debt crisis.

The Treasury Market Strains: When the U.S. Treasury struggled to find buyers for its debt in late 2023, the Fed was forced to adjust its Quantitative Tightening (QT) plans. This effectively shows that the "printing press" must stay ready to support government spending, regardless of the inflation target.

In summary, to accurately read the market and assess whether we are continuing to follow in the footsteps of the 1970’s example, we must observe the policy response:

Reactionary Policy: If prices are high and the central bank is aggressively hiking (positive real interest rates), it is a Supply Shock. In this case, cash often outperforms the broader market as asset prices deflate under the weight of high interest rates.

Accommodative Policy: If prices are high but the central bank is forced to keep interest rates low to support the government's debt, you are witnessing Currency Debasement.

In an era of fiscal dominance, the central bank will most likely choose debasement over debt default. In this environment, hard assets such as gold and silver, may act as the ultimate barometer, rising not just because of "inflation," but because they are the only assets that cannot be printed to solve a fiscal crisis.

Navigating the U.S. government shutdown

When Expectations Carry the Market, Even Small Shifts Matter

This material has been published by Picton Mahoney Asset Management (“PICTON Investments”) on 13 January, 2025.

It is provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by PICTON Investments, nor does PICTON Investments assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

This material may contain “forward-looking information” that is not purely historical in nature. These forward-looking statements are based upon the reasonable beliefs of PICTON Investments as of the date they are made. PICTON Investments assumes no duty, and does not undertake, to update any forward-looking statement. Forward-looking statements are not guarantees of future performance, are subject to numerous assumptions and involve inherent risks and uncertainties about general economic factors which change over time. There is no guarantee that any forward-looking statements will come to pass. We caution you not to place undue reliance on these statements, as a number of important factors could cause actual events or results to differ materially from those expressed or implied in any forward-looking statement made.

This material is confidential and is intended for use by accredited investors or permitted clients in Canada only. Any review, re-transmission, dissemination or other use of this information by persons or entities other than the intended recipient is prohibited.